MiCA regulation (Regulation (EU) 2023/1114) sets requirements for persons who issue crypto assets tokens, and for persons who provide services with such tokens (abb CASP, older abb VASP). The idea is to regulate persons, specifically, to put rules on their capital, procedures, governance, and how they deal with their clients (market conduct rules). Almost all EU regulation on capital markets is based on such an approach, only in certain cases products themselves are regulated (e.g. to some extent UCITS, AIF funds). No identified issuer, as in the case of Bitcoin, – no obligation to comply with MiCA? Not exactly. Article 5 of MiCA deals with such cases and is explicit that requirements apply to persons who seek admission to trading in such cases. So they become responsible for compliance with MiCA requirements instead of issuers.

MiCA will not set rules for AML/TF. Rules on AML/TF are specified in a dedicated AML directive (future-to-be-regulation) in general EU regulation, but not in sectorial legislation. The relation between AML/TF and MiCA is that MiCA will amend AML directive and include in its scope CASPs (except the ones that provide advice). Also, Transfers of funds regulation will become applicable from 2025 for crypto transfers.

MiCA wouldn’t be able to save FTX investors? Not really. 166 pages of MiCA will be complemented by so-called Level 2 regulatory products. ESMA will specify further details for CASPs in its 32 regulatory products and EBA for issuers in its 14 products. In total MiCA has granted over 50 mandates for such specifications. The technical details specified in those regulatory products shall be applied consistently with MiCA. Together will form a full crypto assets regime in the EU.

WHO? WHAT? HOW?

MiCA will regulate assets that are issued using DLT or similar technology if such assets are not regulated so far by the financial services framework. To catch technology that could emerge in the future, the focus is on similar technology. Note, that MiCA only covers a public offer. Consider a public offer as an offer where every member of the public can buy a token. If only insiders (e.g., 5 friends) own tokens and do not intend to trade them in such a way that everyone from the public could buy a token, then it is not a public offer. But if those 5 friends are posting on Instagram how their token is going to disrupt all financial markets’ and urging others to buy it, then it could be considered a public offer.

What is out of the scope of MiCA

- Instruments that are already regulated by the EU capital markets framework. Financial instruments (common shares, derivatives, etc) are regulated by the MiFID framework, so MiFID rules will continue to apply. The same applies to deposits, pension products, etc. The idea is to maintain technological neutrality. However, this principle somehow is not maintained for e-money tokens (EMT). EMTs will be subject to the E-money directive and MiCA requirements. So if e-money are issued in a traditional way, then fewer requirements apply, but if they are issued using DLT, then more requirements apply.

- NFTs – nobody regulates Hot Wheels collectibles, and nobody will regulate collectibles of NFTs either. Hot Wheels Pink Beach Bomb may be worth 150k USD because of its rear model and expectation to sell it at a higher price in the future, but not it has nothing to do with capital markets which permit the flow of capital from those who have it to those who wish to have access to that capital. The same is true with NFTs collectibles.

- Utility tokens for the purpose of usage in a limited network. Hotels or airlines that offer tokens that can be exchanged for souvenirs or award miles will not be regulated under the financial service framework. Again, not capital relocation intention.

- DeFI. DLT is a decentralized technology. Its economic purpose is not, at least at the moment. As long as intermediaries make a profit from their intermediation activity it can not be considered as DeFi in MiCA context, so such activity is in the scope of MiCA.

- Tokens that are created during the mining process.

SAFE(?), SAFER(?), EXTRA SAFE(?) TOKENS

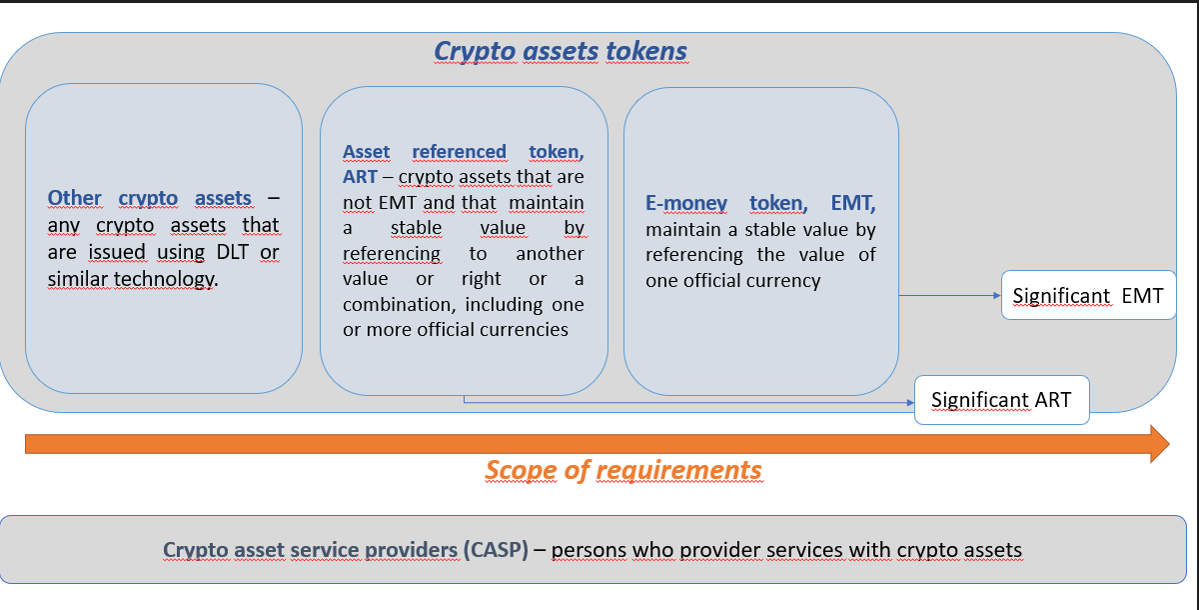

OKAY, not a very suitable superlative when talking about money in general and investments, but maybe somebody will help to think of a better one in the comments. So, under MiCA there are three types of tokens – asset-referenced tokens (ART) and e-money tokens (EMT) – so-called stablecoins, and the third type is other crypto assets. The scope of requirements depends on the rights that the issuer is obliged to grant to token holders under MiCA. Issuers of other crypto assets are not obliged to grant any rights, except the ones which they write down in a white paper (technically, they can promise anything they wish). The key focus is on disclosure requirements. From holders’ perspective, those tokens are protect-yourself-tokens. Holders shall be aware of that and do not be confused of safe heaven. Meanwhile, issuers of stablecoins must guarantee redemption rights, either at market value or par. The reserve of assets that stablecoin issuers must form shall ensure smooth redemptions. Such issuers are subject to comprehensive requirements. EMTs are extra safe ones, since redemption is at par and only credit institutions or e-money institutions can issue them.

ARTs and EMTs can be ordinary or, if they exceed certain thresholds, they become significant. Thresholds include a number of holders over 10 million, market cap over 5 000 million euros. Significant ones are subject to the EU level supervision, and additional bank-like requirements.

A SUMMARY OF REQUIREMENTS

Key requirements for issuers of other crypto assets

- They must be legal persons (there is an exemption, however, it applies in limited cases and only in some member states (MS)). No requirement for authorization.

- Investors need to know what they are buying, therefore issuers must publish a white paper in accordance with Annex I of MiCA and provide it to a national competent authority (NCA). To avoid the provision of the information in a complex fashion, MiCA specifies structure of white paper. Issuers must provide an explanation why tokens are not financial instruments, ARTs or EMTs.

- Publish marketing communication. It must be fair, not misleading, and can’t be published earlier than the white paper.

- Act honestly, prevent conflicts of interest, treat clients fairly and equally, act in the best interest of clients.

- Clients will have 14 days to change their minds if tokens are not listed (i.e., clients can ask for a refund). Great solutions for people who cannot resist the temptation, but use any time to reconsider their action later.

- Protection of clients’ funds (money must be deposited in a credit institution, crypto assets held by a CASP).

And that’s all! Wait, but I haven’t talked yet about market abuse requirements, which cover all listed tokens. They are the ones that will play the greatest role in regulating other crypto assets tokens.

To sum up, other crypto assets issuers will be barely regulated, there are no prudential or market conduct requirements, and the key requirement is to publish a white paper. Since issuers will be legal persons, in case they will not be able to redeem tokens on agreed time, holders can initiate liquidation or restructure procedure. However, it depends on the national laws of each member state.

Key requirements for issuers of ART

- Only credit institutions or legal persons authorized under MiCA can issue ARTs. If a credit institution issues tokens, then it must provide additional information for its NCA and the NCA approves (or not) the new activity. Credit institutions and new ARTs are on the same page. Credit institutions have already gone through an authorization process to prove they are qualified.

- Requirements for shareholders of qualifying holdings, members of the management body.

- Publish a white paper and provide it for a NCA to approve. An approval does not mean that the NCA will review the content of a white paper, it means that the NCA will look at the structure and if all parts of Annex II of MiCA are included.

- Act honestly, prevent conflicts of interest, treat clients fairly and equally, act in the best interest of clients.

- Publish marketing communication. It must be fair and not misleading and can‘t be published earlier than the white paper.

- Prudential requirements. Own funds shall be at least 350k EUR or 2 % of reserve assets or ¼ of the previous years' expenditure (so-called fixed overheads requirement), whichever of those three is higher. Own funds must consist only of CET1 items. Note, that credit institutions can include other instruments (AT1 and T2).

- Requirements on assets reserve. Custodians must be credit institutions, investment firms (for financial instruments), and CASPs (for crypto assets). Reserve of assets will guarantee that the issuer will be able to redeem tokens at market price (MiCA is a bit ambiguous on ART’s redemption at par). Therefore, probably assets of reserve assets will consist of assets that are highly correlated with assets to which tokens are referencing.

- In some cases issuer can redeem tokens by paying back assets (so-called redemption in kind). Before agreeing with this, clients should be familiar with the consequences. In my view, it is not suitable for retail clients in general.

- Issuers cannot be custodians of their assets (must be a separate legal person). The biggest issuers may not like this rule. However, if they could, then technically token holders would become the issuer's creditors.

- Issuers cannot pay interest. The idea behind such requirements is that they would not become bank-like. In a practical context, this means that current market practice with crypto lending, flash loans, etc. will end with MiCA. Usually, financial regulation does not allow to use client’s assets for financial institutions (unless explicit consensus is given by the client).

Key requirements for issuers of EMT

- EMTs are e-money, however, a few additional requirements apply, the key one is the publication of a white paper.

- Only credit institutions or e-money institutions can issue EMTs

- Prohibition to pay interest

- Requirements for reserves of assets, including concentration requirement

In general holders of such tokens should be on the safe side since the credit institutions are appropriately regulated. If an issuer is an e-money institution, then requirements within the EU are not harmonized to the same extent, so holders should be aware of national divergences.

CRYPTO ASSETS SERVICE PROVIDERS

Another block of MiCA is dedicated to crypto assets service providers – legal persons that provide services with all three types of tokens. According to MiCA, there are 10 types of services, such as custodians of wallets (officially, provision custody and administration of crypto-assets on behalf of clients), crypto assets trading platforms (operation of a trading platform for crypto-assets), exchanges of crypto assets (in financial markets it‘s dealing on own account, however, MiCA set lighter regime for this service). And those who provide other services, that are common in financial markets, such as execution of orders, placing of crypto-assets, RTO, advice, portfolio management on crypto-assets. And transfer service for certain tokens.

Key requirements for CASPs

- They must be either regulated entities (investment firms, e-money institutions, etc) and notify for it’s NCA about the intention to provide crypto assets services or be newly authorized entities. Regulated entities can provide only those services that they are providing with traditional instruments.

- Own funds requirement. The amount depends on the services they provide. For exchanges and custodians of wallets, 125k EUR, for trading platforms 150k EUR and for others 50k EUR. Own funds can be in a form of CET1 or insurance policy. So if shareholders are able to find in the market insurance policy, then they do not need to have their own capital.

- Comply with organisational requirements:- Have a registered office in home MS and at least one of managers must reside in the EU. An approach of letter box entity shall be avoided.- Requirements for the management body.- ICT requirements (set out in DORA regulation).- Specific requirements depend on the services that they provide. Since services are similar to MiFID investment services, requirements are inspired by the MiFID framework, although more proportional and adopted for the crypto market.

The passporting is a legal instrument to market tokens and provide crypto assets services within the EU. Under MiCA, conditions will depend on a type of a token. Other crypto assets issuers must notify their NCA member states in which it plans to offer tokens. After 10 days they can start marketing tokens within those member states. In the case of ART, once authorization or approval is granted in one member state, an issuer can offer tokens in all EU. For EMTs, requirements of e-money directive apply. As regards CASPs, during the authorization or approval process, CASP should provide a list of member states in which it intends to offer their services.

The last part of MiCA deals with misconduct – market abuse. Market abuse rules will touch every person as regards listed tokens. In practical context it means there should be less issuance of other crypto assets and crypto trading platforms since they will have to function under requirements that do not allow for them to rip off their clients anymore (I am talking about front running, wash trade, pump and dump).

Few open issues – qualification of crypto assets as financial instruments or other assets. The problem is that financial instruments are not harmonized across the EU. Common shares are governed by a national civil code, Law on Companies, etc. It will be pretty hard for an issuer to explain the qualification if it intends to offer tokens in all EU. Also, it will be interesting to see how it will work in practice without dealing on own account activity (role of market makers). I think holders of other crypto assets tokens may be given the illusion that their investments are on the safe side since regulation will be too complex for them to understand. The sole complaints right will not protect them.

Remark: I have worked with the development of MiCA regulation since 2020. I hope this post will help to understand the overall regulation and explain some logic behind it.

Last modified 8/10/2023